Local Government Pensions Scheme in England and Wales - Scheme Improvements (Access and Protections)

Chapter 4 - New Fair Deal

Definitions

48. For the purposes of this chapter:

-

“Deemed employer” has the meaning given by Part 4 of Schedule 2 in the 2013 Regulations. It has the effect that for specific groups of employees, their ‘Scheme employer’ is not their employer in employment law but is instead their deemed employer.

-

“Fair Deal employer” means a Scheme employer listed in paragraphs 1 to 13 or 15 to 29 of Part 1, or in Part 2, of Schedule 2 in the 2013 Regulations, or a further education corporation or sixth form college corporation as per section 90 of the Further and Higher Education Act 1992. It has the effect of identifying the original employer of individuals who have since been outsourced.

-

“Relevant contractor” means a contractor to whom an employee’s contract of employment is compulsorily transferred under regulation 4 of “The Transfer of Undertakings (Protection of Employment)” (TUPE) regulations from a Fair Deal employer (or a previous contractor). It has the effect of identifying the employer of protected transferees.

Introduction

49. The government consulted in 2016 (2) and 2019 (3) on the introduction of greater pensions protection for eligible employees of Local Government Pension Scheme (LGPS) employers who had been compulsorily transferred to service providers. The 2019 consultation proposed that, in line with the government’s Fair Deal guidance of October 2013 (4) (which specifically did not apply to local government), most LGPS members in this position should have continued access to the LGPS in their employment with the service provider. In doing so, it was proposed that the current option to provide transferring staff with access to a broadly comparable scheme should be removed.

50. In 2022, the government responded to the 2019 consultation by stating that it was reconsidering its approach to Fair Deal in the context of the LGPS and would take account of representations made in response to the 2019 consultation in its next consultation (5).

51. The government is committed to bringing pension protections in local government in line with the government’s Fair Deal guidance of 2013 and this consultation sets out updated policy proposals for introducing Fair Deal in the LGPS, taking account of responses to previous consultations. The aim of these proposals is to ensure that transferred employees retain the security which comes with membership of the LGPS, a statutory scheme with benefits set out in law, and to enable LGPS employers to obtain better value from outsourced service contracts.

Background

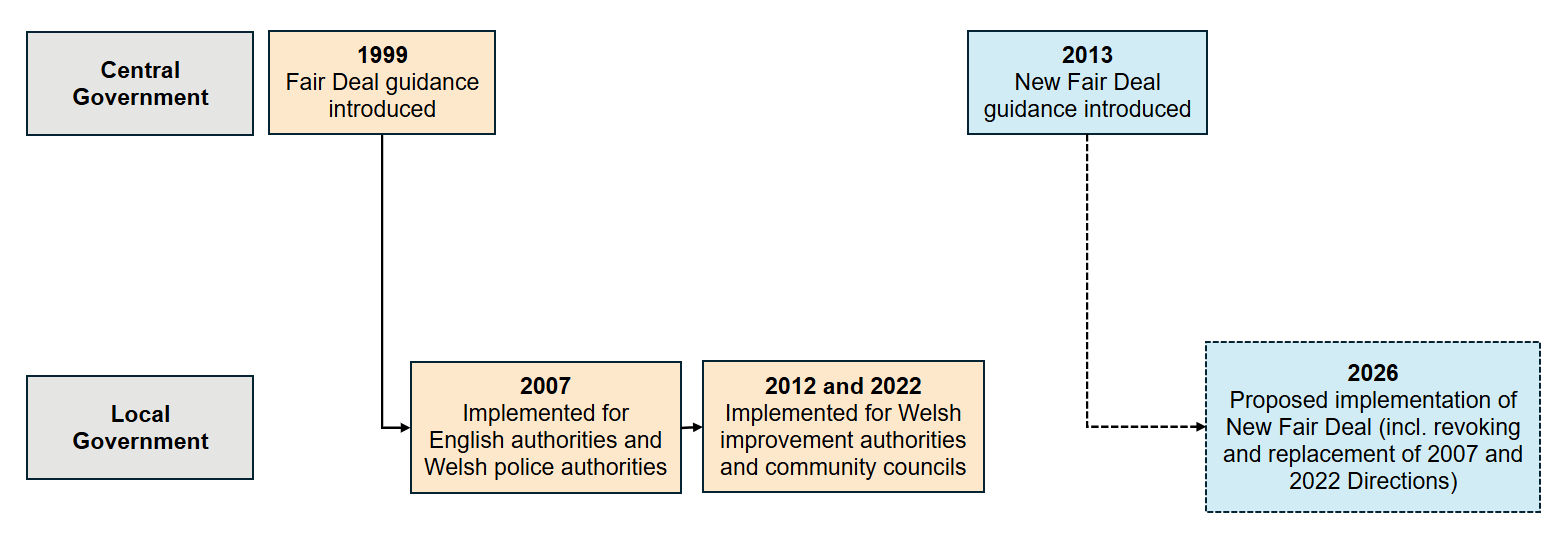

52. The Fair Deal policy was first introduced in 1999, setting out how pensions issues should be dealt with when staff are compulsorily transferred from the public sector to service providers delivering public services. Under the original Fair Deal guidance, transferred staff had to be given continued access to their public service pension scheme or access to a scheme certified by an actuary in accordance with the Government Actuary’s Statement of Practice (6) as being ‘broadly comparable’ to their previous public service pension scheme.

53. Following the publication of the original Fair Deal guidance, pensions protection for local government employees in England and Wales was provided through:

-

the Best Value Authorities Staff Transfers (Pensions) Direction 2007 (7) (‘the 2007 Direction’ – covering employees of English authorities and Welsh Police authorities); and

-

the Welsh Authorities Staff Transfers (Pensions) Direction 2012 (8) (‘the 2012 Direction’ – covering employees of Welsh improvement authorities and community councils), which has since been replaced with the Welsh Authorities Staff Transfers (Pensions) Directions 2022 (9) (‘the 2022 Direction’). To note, Welsh Police Authorities were abolished in 2012 and replaced with Police and Crime Commissioners. Employees of Police and Crime Commissioners are not protected by any of the directions.

54. Under these Directions, protected employees who are transferred to a service provider following the contracting-out of a service or function must be given either continued access to the LGPS, or access to a scheme certified by an actuary to be ‘broadly comparable’ to the LGPS at the time of the transfer. It is the understanding of government that this certification has previously been done in accordance with the aforementioned Government Actuary’s Statement of Practice, and in more recent years in accordance with the principles of the 2013 Fair Deal guidance.

55. HM Treasury published updated Fair Deal guidance in October 2013 (10). It improved pension protection for outsourced central government workers by setting out that they should receive continued access to their public sector pension scheme after a transfer, rather than be provided with access to a broadly comparable scheme. It covers central government departments, agencies, the NHS, maintained schools (including academies) and any other parts of the public sector under the control of Government ministers where staff are eligible to be members of a public service pension scheme. It does not cover authorities listed in section 1 of the Local Government Act 1999.

56. The 2016 consultation proposed that, in line with the 2013 Fair Deal guidance, most compulsorily transferred LGPS members should have continued access to the LGPS in their employment with the service provider. In doing so, it was proposed that the option to provide transferring staff with access to a broadly comparable scheme should be removed.

57. The government response (11) to the 2016 consultation confirmed a commitment to introduce the strengthened Fair Deal in the LGPS but noted that respondents had raised several concerns regarding the specific approach proposed. The government considered the points raised and the 2019 consultation contained updated proposals to implement a strengthened Fair Deal. The government has not published a detailed government response to the 2019 consultation, so those responses have been considered when drafting the updated proposals in this consultation.

58. The 2019 consultation proposed to align with the 2013 Fair Deal guidance by removing the option for broadly comparable schemes to be offered to outsourced local government workers and providing for them to receive continued access to the LGPS instead. It also proposed to offer an alternative route to becoming an LGPS employer for service providers, the ‘deemed employer route’, where the original employer (and not the service provider) would be the Scheme employer. This was proposed as an alternative to admission agreements, which allow service providers to participate in the LGPS as individual Scheme employers.

59. The main aim of introducing the deemed employer route was to simplify pension requirements in outsourced contracts by encouraging further use of pass-through arrangements. Under pass-through, a service provider may pay a fixed contribution rate for the life of the contract or agree to pay contributions within a certain range.

60. The proposals also included an option for staff who were covered by the 2007 and 2012 Directions and had become members of broadly comparable schemes, to transfer their benefits back into the LGPS at the next retender of the contract.

61. Responses to the 2019 consultation were mixed. Whilst many respondents were supportive of the aim to improve pension protections for outsourced local government workers, there were a variety of concerns on the detail of the proposals. Some of the key concerns raised about the 2019 proposals were:

-

That inward transfer terms for those who transfer their benefits from broadly comparable schemes back into the LGPS should be fair to members by honouring any benefits they have accrued with a final salary link.

-

That removing the option for broadly comparable schemes to continue without allowing for any exceptional circumstances could lead to legal issues for outsourcing bodies or service providers e.g., where there is a contractual obligation to provide a broadly comparable scheme.

-

That the draft regulations were a missed opportunity to consider introducing more explicit risk sharing provisions between service providers and outsourcing bodies.

-

That statutory guidance would be needed alongside Scheme Advisory Board guidance.

Figure 1 - Background of Fair Deal

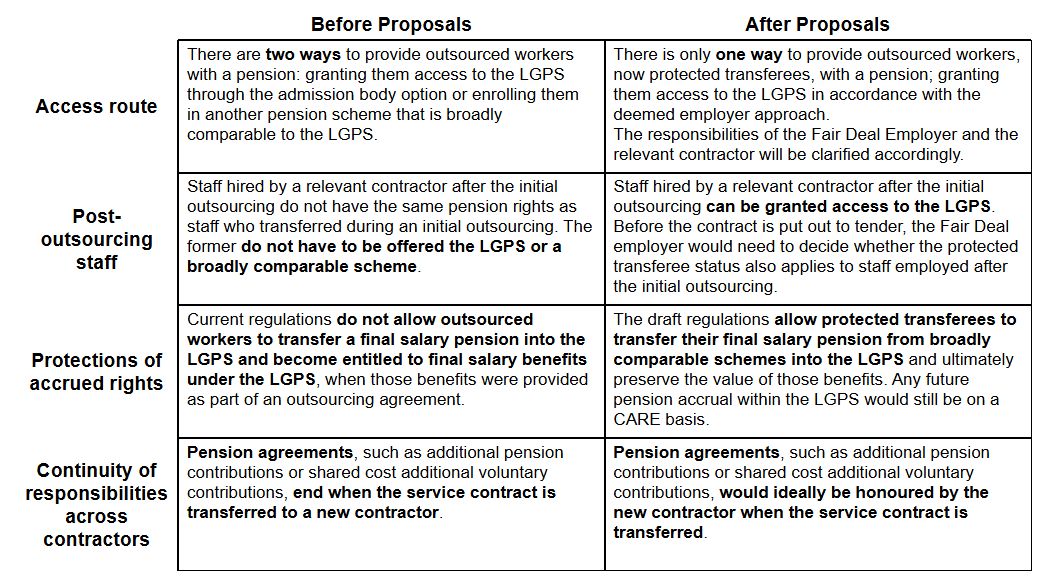

Summary of Proposals

62. This section sets out the detail of the updated proposals (see Table 1 below) to implement the strengthened Fair Deal pension protections in local government. In drafting the updated proposals, the government has fully considered the responses to both the 2016 and 2019 consultations. Where responses to the 2016 or 2019 consultations have directly impacted proposals in this consultation, it is made clear in the text.

63. The draft regulations that would deliver the changes are published alongside this consultation. They would apply in both England and Wales (unless clearly specified) and provide for the introduction of a new Schedule 2A to the 2013 Regulations (12). Where necessary, new statutory guidance will be published alongside the regulations to provide further detail on how the regulations should be applied. Further detail of what the government is planning to include in this guidance can be found in the section “Implementation of New Fair Deal proposals.”

Table 1 - Summary of effect of New Fair Deal proposals